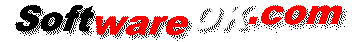

There are many untruths about inflation, most of which are exaggerated to cover up the true loss of value of money and to lull everyone into a false sense of security!But there are currencies or precious metals that reflect real inflation quite accurately! Contents: 1.) ... Gold as the basis for inflation!

|

| (Image-1) Real inflation! |

|

2.) Why is inflation calculated differently?

You don't want to panic, and the real number would accelerate inflation by an unknown factor! You want to avoid this and have your own calculation.

Why not, when it's so simple! Inflation can only be viewed retrospectively anyway and cannot be calculated in the short term! They are only estimates, it's like the weather!

►► https://www.ihrfinanzdoktor.com/6-tipps-f%C3%BCr-ihr-geld/inflation/

| (Image-2) How do I calculate real inflation! |

|

3.) Further thoughts and discrepancies in the calculation!

Real inflation refers to the actual change in the purchasing power of your money due to inflation. To find real inflation, you need to subtract nominal inflation (the official inflation rate) from your personal situation. Here are some steps that can help you:

Find the official inflation rate:

The official inflation rate is published by government agencies or statistical offices in most countries. In the United States, for example, the inflation rate is determined by the Bureau of Labor Statistics and released monthly. You can find the official inflation rate on those agencies' websites or in business news articles.

Check your personal spending:

To determine real inflation for yourself, you'll need to analyze your personal spending. Make a list of the things you regularly buy and write down the prices.

Compare price increases:

Compare the prices for the items on your list over a period of time (such as a year or more). Pay attention to how prices compare to the official inflation rate.

Calculate real inflation:

Subtract the percentage change in your personal spending from the official inflation rate. For example, if your personal spending increased 3% in one year, but the official inflation rate is only 2%, your real inflation is 1%.

It's important to note that real inflation can vary from person to person, as spending and consumption habits vary. If you want to get a more accurate picture of inflation in relation to your own spending, you can keep a budget book to track your expenses and prices over time.

Additionally, it may be wise to consider long-term investments and investments to protect your wealth from the effects of inflation, as inflation can reduce the purchasing power of your money over time. A financial advisor can help you develop a strategy for dealing with inflation.

FAQ 114: Updated on: 26 February 2025 08:38